Economic Overview of Nigeria’s Domestic Airline Industry in 2024

The past decade has been a rollercoaster for Nigeria’s domestic airline industry, with ups and downs influenced by various economic and global factors. As we move into 2024, careful consideration of economic indicators, government policies, insecurity, and global events will be essential for stakeholders in the aviation sector. By staying vigilant and adapting to the dynamic environment, Nigeria’s domestic airline industry can navigate challenges and capitalize on opportunities for sustainable growth in the years to come. This article explores the trends observed in domestic passenger traffic in Nigeria from 2013 to 2022, providing insights into the fluctuations and forecasting potential future developments.

Data Analytics

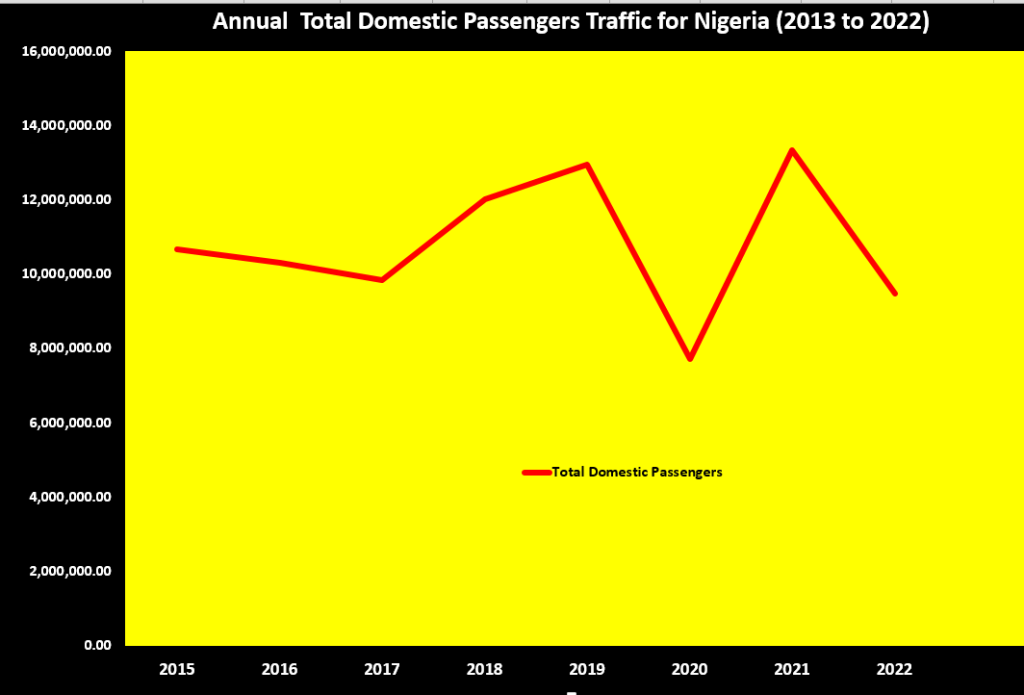

The total domestic airline passenger traffic in Nigeria has experienced fluctuations over the years. In 2013, the industry recorded 10,074,528 passengers, and this number increased steadily until 2018, reaching a peak of 12,031,336 passengers. However, 2019 marked a slight dip with 12,949,464 passengers, and the industry faced a significant setback in 2020 with only 7,721,114 passengers—a consequence of the global pandemic.

Despite the challenges posed by the pandemic, the industry rebounded in 2021, recording 13,339,634 passengers, surpassing the pre-pandemic levels. However, the figures for 2022 show a decline to 9,480,820.57 passengers, raising questions about the factors influencing this downward trend.

Pearson Correlation Coefficient:

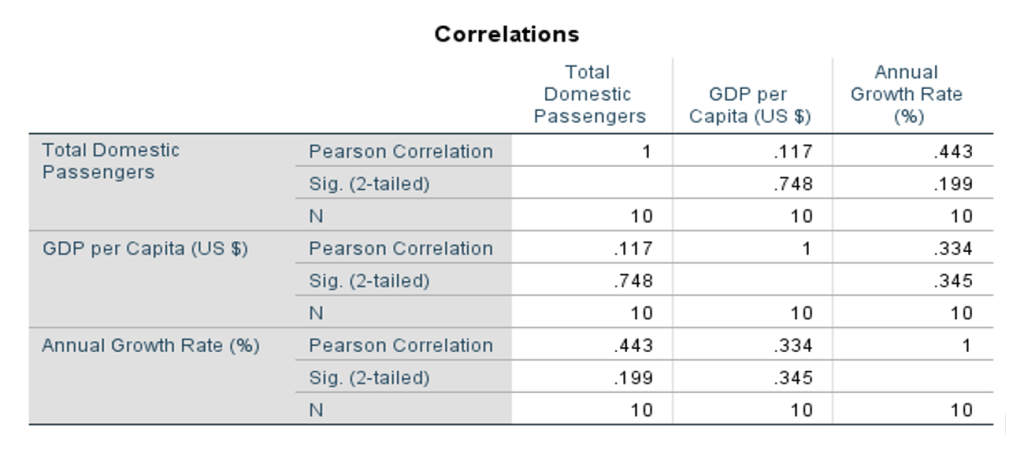

For “Total Domestic Passengers” and “GDP per Capita (US $),” the Pearson correlation coefficient is 0.117.

The Pearson correlation coefficient ranges from -1 to 1. A value of 1 indicates a perfect positive linear relationship, -1 indicates a perfect negative linear relationship, and 0 indicates no linear relationship.

In this case, the correlation coefficient is close to 0.117, suggesting a very weak positive correlation between the total domestic passengers and GDP per capita.

Significance (Sig.) Level:

The significance level, often denoted as “Sig. (2-tailed),” is 0.748.

The significance level indicates the probability of observing a correlation as extreme as the one computed, assuming that there is no actual correlation in the population.

In this case, a significance level of 0.748 is relatively high, suggesting that the correlation observed could be due to random chance. Typically, a significance level below 0.05 is considered statistically significant.

Sample Size (N):

The sample size for both variables is 10.

Interpretation:

The weak positive correlation coefficient (0.117) indicates a slight tendency for total domestic passengers and GDP per capita to move in the same direction. However, the relatively high significance level (0.748) suggests that this correlation may not be statistically significant, and the observed relationship could be due to chance rather than a genuine association.

In practical terms, this means that, based on the data provided, there is limited evidence to conclude that there is a significant linear relationship between total domestic passengers and GDP per capita in the given context. It’s crucial to consider additional factors and conduct further analysis to draw more robust conclusions about the relationship between these two variables.

Factors Influencing Trends

Several factors contribute to the fluctuations in domestic airline passenger traffic in Nigeria. Economic conditions, government policies, insecurity, aviation fuel prices, and global events such as the COVID-19 pandemic all play a role in shaping the industry’s performance.

The data reveals fluctuating trends in domestic passenger traffic over the years. In 2013, the total number of domestic passengers stood at 10,074,528, and this figure experienced a steady increase until it reached its peak in 2019 at 12,949,464 passengers. However, a significant drop was witnessed in 2020, when the number plummeted to 7,721,114 due to the global pandemic’s unprecedented impact on the aviation industry. The sector faced operational challenges, travel restrictions, and a decline in passenger confidence.

Impact of the COVID-19 Pandemic:

The year 2020 stands out as a turning point in the domestic passenger traffic landscape. The sharp decline was primarily attributed to the disruptions caused by the COVID-19 pandemic. Airlines faced operational restrictions, reduced flight frequencies, and a decline in consumer demand. The subsequent recovery in 2021, with 13,339,634 passengers, indicates a gradual return to normalcy as the aviation industry adapted to the new normal with enhanced safety measures and increased vaccination efforts.

Economic Factors:

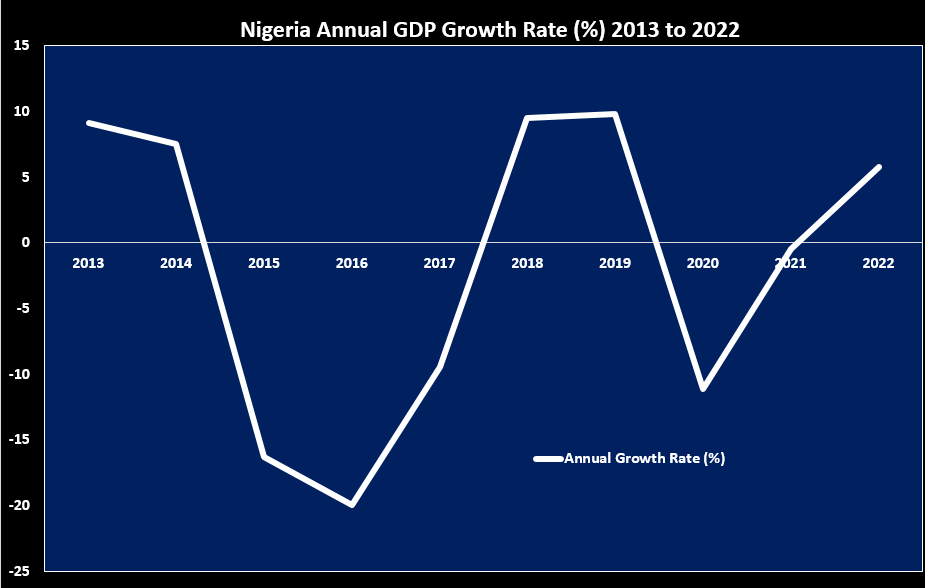

Economic conditions have played a crucial role in shaping domestic passenger traffic patterns. Fluctuations in GDP growth, inflation rates, insecurity, and income levels impact people’s ability to travel. The years with higher passenger numbers often correlate with periods of economic stability, increased kidnappings on roads, and growth, highlighting the interdependence between the aviation industry and the overall economic health of the country.

- Fixing Aviation Surety Bonds in Nigeria

- When Safety Meets the Clock: Why Airlines Can’t Afford to Gamble

- NSIB Hosts 12th BAGAIA Commission Meeting in Abuja

- ✈️ How Commercial Airlines Boost Nigeria’s GDP

- Error Management Techniques in Flight Operations

Security Factors:

Over the past decade, escalating insecurity on key Nigerian roads, notably marked by repeated kidnappings since 2016, has profoundly shaped decisions regarding airline passenger traffic. The persistent threat of attacks by bandits has substantially influenced travelers to opt for air travel, circumventing routes plagued by security concerns. This shift is evident in the increasing reliance on air transportation, particularly during the years marked by economic growth, such as 2018 and 2019. The aviation industry has emerged as a preferred choice, providing a safer alternative amid the challenges posed by insecurity on major roadways. The impact of these security considerations is evident in the fluctuations of airline passenger numbers, reflecting the evolving landscape of travel preferences in response to heightened concerns over safety and security.

Technological Advancements:

The aviation sector has witnessed technological advancements, contributing to improved efficiency and safety. Increased connectivity, online booking platforms, and digital transformation have made air travel more accessible and convenient. These advancements are expected to continue influencing passenger behavior and contributing to future growth.

Forecasting Future Trends:

While predicting the future is inherently uncertain, drawing insights from historical data and potential developments allows us to make informed forecasts. Key influencers, including economic recovery, global events, security concerns on Nigerian roads, and technological advancements, are poised to shape the trajectory of domestic passenger traffic in Nigeria. As the world adapts to the post-pandemic landscape, the aviation industry is anticipated to undergo a gradual resurgence, with passenger numbers edging closer to pre-pandemic levels. However, given the concerted efforts by the current government and newly appointed security chiefs to address security challenges on Nigerian roads, coupled with the impact of inflation on the populace, the consulting teams at Cliqjets believe that the outlook for passenger traffic in 2024 may face challenges that will negatively affect the recovery of the industry from Covid-19 impact.

Conclusion

Over the past decade, Nigeria’s domestic passenger traffic has navigated a terrain marked by both challenges and triumphs. The sector’s resilience shines through, evident in its ability to bounce back from the disruptions caused by the COVID-19 pandemic. As we set our sights on the future, Nigeria’s aviation industry stands on a point of transition of growth to be driven by economic stability, technological advancements, and a changing travel landscape.

Yet, a critical factor demands our attention – the security landscape. A security improvement could tilt the preference of Nigerians towards road travel, particularly in light of the recent surge in flight ticket prices. It is paramount for stakeholders, including airlines, regulators, and policymakers, to collaboratively chart a course that ensures the sustainability and prosperity of Nigeria’s domestic aviation sector in the years ahead.

hello there and thank you for your information – I have certainly picked up something new from right here.

I did however expertise some technical points using this site, since I experienced to reload the site lots of

times previous to I could get it to load correctly. I had

been wondering if your web hosting is OK? Not that I’m complaining,

but slow loading instances times will very frequently affect

your placement in google and could damage your high quality score if advertising and marketing

with Adwords. Anyway I’m adding this RSS to my email and can look out for a lot more of your respective intriguing content.

Make sure you update this again soon.. Lista escape room

I like this web site it’s a master piece! Glad I noticed this on google.?

I was reading some of your articles on this internet site and I conceive this internet

site is rattling informative! Keep on putting up. Travel blog

I really like reading an article that will make people think. Also, many thanks for permitting me to comment.

I’m impressed, I have to admit. Rarely do I come across a blog that’s equally educative and entertaining, and let me tell you, you have hit the nail on the head. The issue is something that too few folks are speaking intelligently about. I’m very happy I came across this in my search for something relating to this.

I was pretty pleased to find this page. I need to to thank you for your time due to this wonderful read!! I definitely liked every bit of it and i also have you bookmarked to look at new things on your website.

I’d like to thank you for the efforts you have put in penning this site. I’m hoping to see the same high-grade blog posts by you later on as well. In fact, your creative writing abilities has motivated me to get my very own blog now 😉

Oh my goodness! Amazing article dude! Many thanks, However I am experiencing troubles with your RSS. I don’t know why I can’t join it. Is there anyone else having identical RSS problems? Anybody who knows the solution will you kindly respond? Thanks!

I’m impressed, I have to admit. Seldom do I come across a blog that’s equally educative and amusing, and without a doubt, you’ve hit the nail on the head. The problem is something which too few people are speaking intelligently about. I’m very happy I stumbled across this in my search for something concerning this.

Aw, this was an incredibly nice post. Finding the time and actual effort to make a top notch article… but what can I say… I hesitate a lot and don’t seem to get nearly anything done.

It’s hard to find knowledgeable people on this topic, however, you seem like you know what you’re talking about! Thanks

I like it when people get together and share views. Great blog, keep it up!

Good information. Lucky me I discovered your website by accident (stumbleupon). I’ve saved it for later.

I quite like looking through a post that can make men and women think. Also, thank you for allowing me to comment.

It’s hard to find experienced people about this subject, but you sound like you know what you’re talking about! Thanks

This page certainly has all of the information and facts I needed about this subject and didn’t know who to ask.

May I just say what a relief to uncover an individual who actually understands what they’re discussing on the net. You certainly understand how to bring an issue to light and make it important. More and more people have to check this out and understand this side of your story. It’s surprising you are not more popular since you certainly have the gift.

I absolutely love your site.. Pleasant colors & theme. Did you create this web site yourself? Please reply back as I’m looking to create my own personal website and would like to learn where you got this from or just what the theme is named. Thanks.

I love it when individuals come together and share opinions. Great site, stick with it.

Hey there! Do you know if they make any plugins to help with SEO?

I’m trying to get my website to rank for some targeted keywords but

I’m not seeing very good success. If you know of any please share.

Many thanks! I saw similar article here: Bij nl

Good info. Lucky me I recently found your site by accident (stumbleupon). I have saved it for later!

You need to be a part of a contest for one of the highest quality sites online. I am going to highly recommend this website!

I could not resist commenting. Very well written!

Having read this I thought it was really enlightening. I appreciate you finding the time and effort to put this short article together. I once again find myself personally spending a lot of time both reading and commenting. But so what, it was still worth it.

I couldn’t resist commenting. Perfectly written!

After checking out a number of the articles on your website, I truly like your technique of writing a blog. I bookmarked it to my bookmark webpage list and will be checking back soon. Take a look at my web site too and let me know your opinion.

Greetings! Very helpful advice within this article! It’s the little changes that produce the most significant changes. Thanks a lot for sharing!

We are glad is usefull toyou

I was extremely pleased to discover this page. I need to to thank you for your time just for this fantastic read!! I definitely liked every part of it and I have you book-marked to see new information in your site.

This page certainly has all the information and facts I wanted about this subject and didn’t know who to ask.

It’s nearly impossible to find well-informed people in this particular subject, however, you sound like you know what you’re talking about! Thanks