Nigerian airlines need to grasp the concept of demand elasticity for their services and incorporate it into their pricing decisions and profitability strategies. Recognizing and effectively managing demand elasticity is crucial for maintaining competitiveness and profitability in the dynamic and intricate airline industry. Given the industry’s inherent complexity and sensitivity, even marginal changes in its various elements can significantly impact profitability due to the high economic elasticity of airline service demand and pricing.

In navigating this challenging landscape, airlines must remain agile and responsive. Despite the industry’s inherent price elasticity, sustained profitability and viability are achievable when owners prioritize operational effectiveness, regulatory compliance, innovation, professionalism in all aspects of their operations, and the utilization of data for informed decision-making.

This article aims to delve into the interplay between airline profitability, the law of demand, and ticket price elasticity, shedding light on the intricate dynamics that shape the industry’s economic landscape.

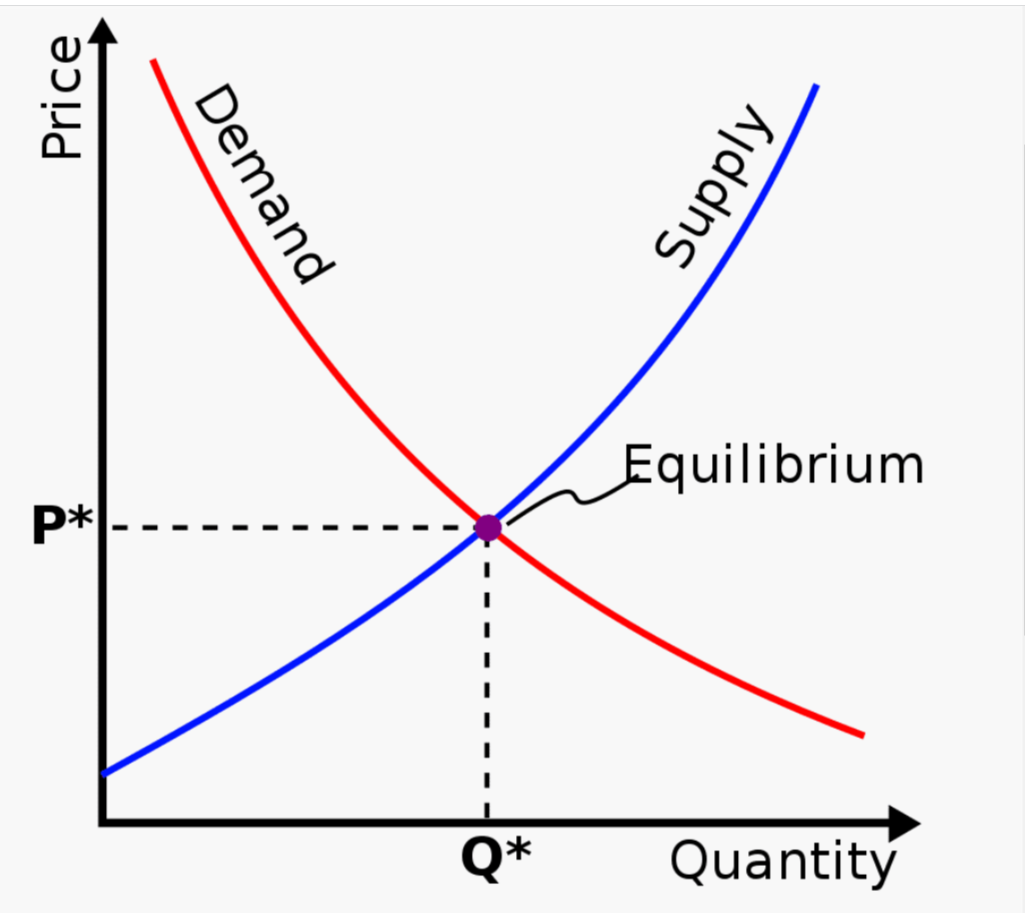

Law of Demand:

The nexus between demand elasticity and profitability holds paramount importance for Nigerian airlines, influencing their pricing strategies and ultimately impacting the financial bottom line. In essence, businesses confronting elastic demand for their services possess greater maneuverability to augment prices without witnessing a substantial loss in clientele. Conversely, enterprises grappling with inelastic demand may find it challenging to hike prices without incurring a notable reduction in sales volume. Consequently, when the price of airline tickets ascends, there is a corresponding decline in the number of passengers seeking tickets. Conversely, a decrease in ticket prices results in an upsurge in the demand for tickets (Kenton, 2020). Given the current scenario where the demand elasticity for airline services in Nigeria has significantly dwindled amid escalating competition from new market entrants, airlines operating in Nigeria must diligently undertake comprehensive market research and analysis before determining their ticket rates vis-à-vis their operational costs.

Ticket Prices and Elasticity:

The elasticity of demand for airline tickets is a multifaceted concept influenced by various factors, contributing to the complexity of pricing strategies in the airline industry. Key determinants include the availability of substitutes, such as alternative modes of transportation or different destination choices.

Setting optimal airfare proves challenging, particularly in the context of a highly competitive business environment. The pricing decisions undertaken by the commercial department of an airline play a pivotal role in determining the company’s profitability. This complexity arises due to the intricate interplay of factors that influence consumer decisions, making it imperative for airlines to comprehend and leverage the concept of “price elasticity.”

Price elasticity, a fundamental economic principle, refers to the degree of responsiveness exhibited by consumers to changes in ticket prices. The elasticity of demand for airline tickets is a crucial aspect that necessitates a nuanced understanding of effective pricing strategies. Achieving the delicate balance between maximizing revenue and ensuring customer satisfaction becomes paramount in this scenario.

In the pursuit of setting optimal airfares, airlines can turn to data analytics as a powerful tool. By leveraging advanced analytical techniques, airlines can predict demand at various price points, enabling them to make informed decisions about pricing strategies. This data-driven approach enhances the ability to adapt to market dynamics and consumer behavior, contributing to more agile and effective pricing structures.

Ultimately, recognizing and navigating the complexities of price elasticity is indispensable for airlines seeking to thrive in a dynamic and competitive industry. The careful consideration of various influencing factors and the integration of data analytics empower airlines to strike a balance between competitive pricing and sustainable profitability, making pricing one of the most formidable challenges faced by the commercial departments of airlines today (Gallo, 2015).

Demand elasticity for airlines is classified into 3 categories and each one describes how passengers will react to a change in prices:

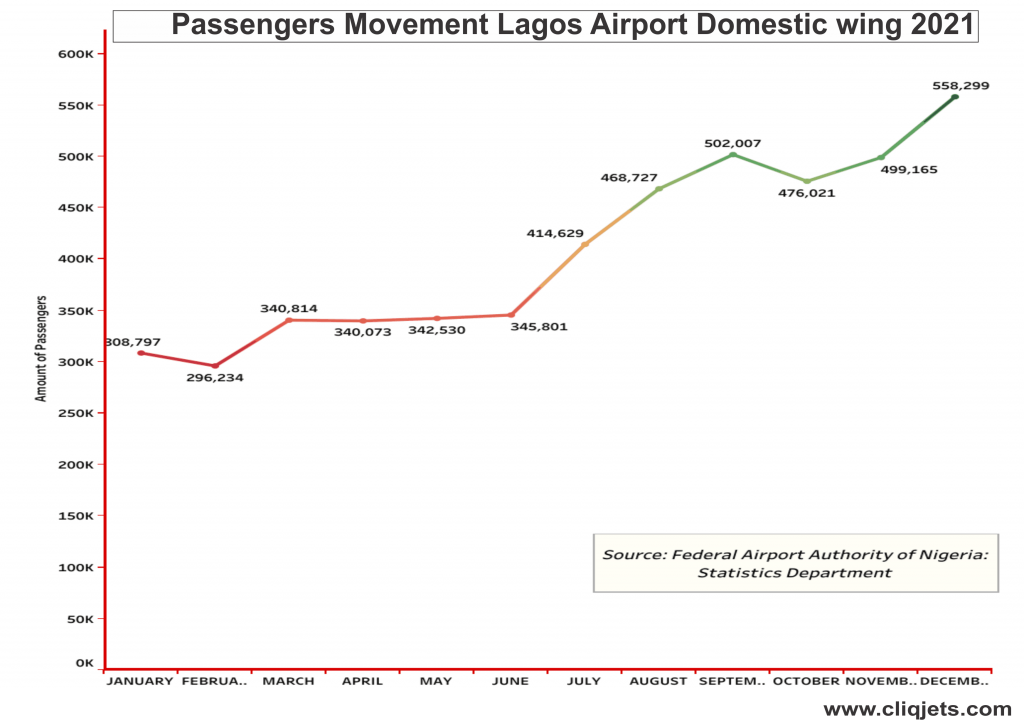

Inelastic Demand: This suggests that, despite a substantial increase in ticket prices, there continues to be a substantial demand for tickets. For instance, let’s examine the situation in Nigeria, as illustrated in the graph below where airlines adjusted ticket prices to align with the country’s economic conditions and the holiday season, specifically Christmas. Surprisingly, the demand did not decrease significantly during this period. This phenomenon can be attributed to the holiday season, coupled with the absence of reliable alternatives for travel, given the prevalent insecurity issues in the country. Refer to Figure 1 for a visualization of passenger movement at Lagos domestic airport in 2021.

Elastic Demand: Elastic Demand in the airline industry implies that slight alterations in ticket prices can lead to a substantial shift in passenger demand frequency. For example, when an airline reduces ticket prices, even by a small margin, for popular routes such as Lagos-Abuja, Lagos-Port Harcourt, and Lagos-Kano in Nigeria, customers tend to quickly capitalize on the opportunity to purchase tickets. However, this surge in demand may be constrained if there are no available seats due to economic challenges and security concerns within the country.

Demand Elasticity and Profitability:

The airline industry’s profitability is highly dependent on pricing strategies, which can be influenced by demand elasticity. Airlines with more elastic demand may need to lower their prices to attract more customers, while airlines with less elastic demand may be able to charge higher prices. Every airline must be able to turn a profit, and if they are ever unable to do so for whatever reason, it poses a major risk to the operations’ safety, sustainability, effectiveness, and compliance. The airline’s revenues are jeopardized if ticket prices are excessive or do not take into account the important elements affecting passengers’ decisions to buy tickets. Therefore, it is a wonderful accomplishment for any airline to assess and determine the appropriate ticket price that will boost customer loyalty (Fernando, 2021).

Conclusion

In conclusion, airline proprietors should prioritize the judicious application of economic principles when formulating marketing strategies. This approach is essential to gain a competitive edge over industry rivals by harnessing data effectively for economically motivated decision-making aimed at enhancing profitability. Considering the current scenario in Nigeria, the imperative for any airline’s success lies in the implementation of competitive pricing strategies. Beyond just price elasticity of demand, airlines must conscientiously evaluate various factors influencing profitability, including fuel costs, labor expenses, airport fees, and taxes. A strategic focus on meticulous cost management and operational optimization is pivotal for successful airlines aiming to maximize their profitability.

Also, read:

How Culture and Society Affect Crisis Management in Flight Operations

<strong>Planning Fallacy in Flight Operations</strong>

- How Nigerian Banks Can Leverage IDERA to Revitalize the Airline Industry

- Aircraft Leasing and the Role of IDERA in Nigeria’s Airline Industry

- Managing Stress and Fatigue: A Shared Responsibility

- Aviation Industry: A Call for Integrity and Intentional Change

- Nigeria Lost the USA FAA Category One Rating: #Implications

References

Fernando, J. (2021, September 12). R-Squared Definition. Investopedia; Dotdash Meredith. https://www.investopedia.com/terms/r/r-squared.asp

Gallo, A. (2015, August 21). A Refresher on Price Elasticity. Harvard Business Review. https://hbr.org/2015/08/a-refresher-on-price-elasticity

Kenton, W. (2020, April 29). Price Elasticity of Demand. Investopedia. https://www.investopedia.com/terms/p/priceelasticity.asp

Great insight

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

sakti55 sakti55

Greetings from Carolina! I’m bored at work so I decided to check

out your website on my iphone during lunch break.

I really like the info you provide here and can’t wait to take a look when I get home.

I’m shocked at how quick your blog loaded on my

mobile .. I’m not even using WIFI, just 3G .. Anyhow, good site!

indomaster88 indomaster88 indomaster88

Pretty! This was a really wonderful post.

Thanks for supplying these details.